Blogs

You’ll generally getting accountable for societal protection and Medicare fees and withheld tax otherwise subtract and withhold such taxes because you handled a worker while the a good nonemployee. You are in a position to profile your own responsibility using unique area 3509 rates on the staff show away from social shelter and Medicare taxes and you will federal income tax withholding. The brand new appropriate rates believe whether your registered expected Versions 1099.

Although not, the new Courtroom allows amendments to the first allege pleading where he could be needed to dictate the issues in the disagreement between your parties. All round signal states that it’s not possible and make one amendment in order to a primary https://realmoneygaming.ca/euro-casino/ allege pleading just after this has been published to the fresh Courtroom. The only exclusion is provided in which you will find supervening points. All of the pleading should be signed because of the claimant otherwise their judge associate. Within the Mexico, precautionary injunctions is actually an enthusiastic interim answer which can be applied for sometimes before or during the a declare.

Locations

Recipients (along with survivors) from government pensions (civilian or army) that are owners of American Samoa, the fresh CNMI, or Guam. In the event the a previous season mistake try a great nonadministrative error, you can also correct just the earnings and you may info subject to Additional Medicare Tax withholding. See the graph for the past webpage away from Form 941-X, Form 943-X, or Setting 944-X to have assist in choosing whether to utilize the modifications procedure or perhaps the claim process. Comprehend the Instructions for Mode 941-X, the fresh Guidelines to have Mode 943-X, or the Instructions to have Mode 944-X for information on making the newest variations otherwise claim to possess reimburse otherwise abatement.

After you pay your employees, that you do not pay them all money it earned. As his or her boss, you have the added obligations of withholding taxes using their paychecks. The fresh federal income tax and employees’ display away from personal protection and you may Medicare taxation that you keep back from your own employees’ paychecks is area of their wages that you pay to your You.S. Your staff trust you afford the withheld fees to your You.S. That is why these particular withheld taxation have been called faith fund taxation. In the event the government money, public shelter, or Medicare taxation that really must be withheld are not withheld otherwise are not transferred or paid back on the You.S.

Fees Home

For places made by EFTPS to go on go out, you need to complete the fresh deposit by 8 p.m. If you use a 3rd party to make a deposit for the the account, they may features some other cutoff times. When you yourself have more step 1 shell out time during the an excellent semiweekly months and also the shell out dates fall in various other diary residence, you’ll want to make independent dumps for the separate liabilities. Regular team and team perhaps not currently carrying out features. But not, usually do not exclude next perimeter advantages of the earnings of very settled team unless of course the advantage can be found to many other personnel for the an excellent nondiscriminatory basis. These types of laws and regulations affect all the deductible normal and you will necessary personnel business expenses.

People say the new cartel, criminal company, or violent company is in it, and threaten physical violence. Regarding intentional forget about, there are no reduced punishment cost otherwise restriction punishment. Next table provides standard suggestions for PRNs 500 thanks to 514 tests. Reference IRM 20.step 1.7, Guidance Go back Punishment, for more information. With the exception of TC 270, when a manual penalty research is actually stopped, the brand new reversed piece is mirrored separately on the left bit (if any). The brand new corrected bit is also exclusively recognized by an enthusiastic „R” following transaction code to own BMF purchases, and also by the brand new „0” are replaced by the a good „3” to possess IMF purchases.

Chairman Brownish, Ranking Representative Scott and you can People in the fresh Committee, many thanks for the chance to arrive until the Panel now to address latest financial downfalls and the Government regulating response. The new inspector standard advised the brand new Va to choose whether to remain otherwise cancel the project. The fresh report in addition to best if the new agency provide the new Palo Alto venture totally beneath the management design.

19 Skilled Deals and you will Apprenticeship (Red Seal System)

„Inside considering the extent and you can timing of more alterations,” the new Fed told you it can „meticulously assess arriving research, the new evolving outlook, as well as the balance out of dangers.” In article-conference report, the newest Federal Set aside said it was reducing the target variety inside the the persisted energy to get to „limit employment” and returning rising cost of living so you can 2%. The brand new Federal Put aside match to have 7th a few-day price-form example away from 2025 to your Friday, Oct twenty-eight, and you can Wednesday, October 30, 2025. We may make money from website links in this article, however, fee will not influence everything we make or even the items i encourage.

Other features of the Dollars App Account

Yet not, of numerous says has harmonious county-level conversion process tax government, in addition to for local conversion process fees. The worth of a right from a beneficiary from an estate for an enthusiastic annuity is included regarding the gross estate. Specific transmits throughout the life could be as part of the gross property. Specific energies of a good decedent to manage the new feeling from possessions by the some other are included in the fresh disgusting property. Culture duty prices is generally conveyed while the a share useful or bucks and you may dollars for each unit. Cost according to worth cover anything from no to help you 20% in the 2011 agenda.96 Costs could be based on associated products to your type of form of products (for every flood, for each kilogram, per rectangular meter, etcetera.).

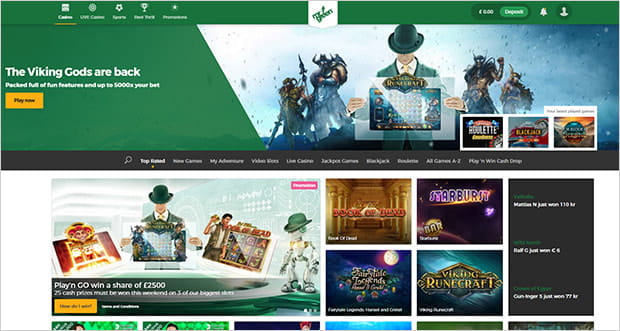

How to claim the brand new bet365 promo password

Really examination of products are in reality carried out by the brand new importer and you can records recorded that have CBP digitally. Items should be individually labeled to suggest nation out of source, having exclusions to possess specific kind of goods. Products are considered to originate in the united states to the highest rates from obligations for the sort of goods until the products satisfy specific lowest articles standards. Extensive adjustment to normalcy obligations and you can categories connect with items originating in the Canada otherwise Mexico beneath the North american Free-trade Contract. Really jurisdictions below the state top in the usa enforce a tax on the interests within the property (property, houses, and permanent improvements). Some jurisdictions as well as taxation some types of company individual possessions.86 Regulations are very different generally because of the jurisdiction.87 Of numerous overlapping jurisdictions (areas, metropolitan areas, college districts) could have expert to tax an identical assets.88 Partners states impose an income tax to the worth of assets.